Table of Contents

In the high-stakes world of financial trading, communication is the backbone of success. Every second counts, and every delay risks missed opportunities or significant losses. Traders must share insights, react to market shifts, and execute decisions faster than ever. Traditionally, emails, phone calls, and specialized apps have been the go-to methods for communication. However, these tools come with limitations—delayed responses, cluttered inboxes, or complex interfaces. Here we’re going to discuss the New SMS for Trading Teams.

Enter SMS, the most straightforward yet powerful communication tool. Once seen as a basic personal messaging system, SMS has evolved into a game-changing tool for trading groups. Its speed, reliability, simplicity, and adaptability are making it indispensable for traders navigating today’s fast-moving markets.

This article explores how SMS is now for trading teams and is transforming trading group communication and why it’s the future of collaboration in the financial sector.

The Speed Advantage of SMS in Trading

In trading, time is money. Market conditions can shift in seconds, and the ability to communicate quickly can make the difference between capitalizing on an opportunity or incurring a loss. SMS stands out as the fastest and most direct communication channel available today.

Emails, while useful for detailed correspondence, often face delays due to clogged inboxes or spam filters. App-based notifications, while faster, can get lost in the barrage of updates traders receive daily. In contrast, SMS ensures instant delivery and is highly likely to be seen.

Studies show that 98% of SMS messages are read within three minutes, making it the most effective way to convey time-sensitive information.

Real-World Use Case

Consider a scenario where a significant market event, like a central bank announcement, triggers a sudden price swing. A trading team leader needs to alert the group to act swiftly. An email might go unnoticed for critical minutes, and app-based alerts may require users to navigate interfaces. With SMS, the alert reaches traders directly and immediately, enabling quicker action.

Actionable Messaging

SMS also promotes clarity and decisiveness. Messages sent via SMS are typically concise and to the point. A simple “BUY ABC Stock @ $100 NOW – Target $105” is far more actionable than a lengthy email explanation. This brevity reduces misinterpretation and speeds up decision-making.

Enhanced Security for Sensitive Trading Information

In financial trading, safeguarding sensitive information is paramount. Trading teams share proprietary strategies, market insights, and transaction details, all of which must remain confidential. A breach could have catastrophic financial and reputational consequences. SMS offers a secure solution that meets the needs of modern traders.

Encryption and Data Privacy

Modern SMS platforms often incorporate encryption, ensuring messages are protected from interception during transmission. This level of security is crucial when sharing sensitive trade instructions or market updates.

Regulatory Compliance

Many SMS solutions are designed with financial regulations in mind. Trading groups must comply with industry standards, such as the SEC’s requirements for archiving communications. SMS platforms tailored for the financial sector can automatically log and archive messages, providing a secure and compliant record of all exchanges.

Case Study

A proprietary trading firm faced challenges with securing internal communications on email and third-party apps. After transitioning to an encrypted SMS platform, they not only improved their security but also streamlined compliance with industry regulations. The firm now enjoys peace of mind knowing their messages are both private and compliant.

Accessibility and Simplicity in Communication

Trading teams often consist of diverse members with varying levels of technical expertise. From seasoned veterans to junior analysts, everyone must stay connected. SMS offers unparalleled simplicity and accessibility, ensuring seamless communication across the board.

Universal Availability

SMS works on virtually all mobile devices, regardless of model or internet connectivity. Unlike app-based communication tools that require downloads, updates, and internet access, SMS functions reliably even during network disruptions or in areas with poor connectivity.

Ease of Use

SMS for trading teams requires no special training or setup. Every trader already knows how to send and receive text messages. This familiarity eliminates the learning curve and allows new team members to integrate into communication channels instantly.

Expert Insight

A trading veteran remarked, “In fast-moving markets, the last thing I want is to fumble with complex tools. SMS gets the message across, plain and simple.” This sentiment underscores the value of simplicity in high-pressure environments.

Cost-Effective and Scalable Communication

For trading groups, cost management is as important as efficient communication. With SMS, trading teams can achieve both. It offers a cost-effective alternative to expensive communication platforms while delivering reliable performance.

Affordable Pricing

Sending an SMS costs significantly less than maintaining specialized communication tools or enterprise-grade apps. For small trading groups or startups, this affordability can make a significant difference.

Scalability

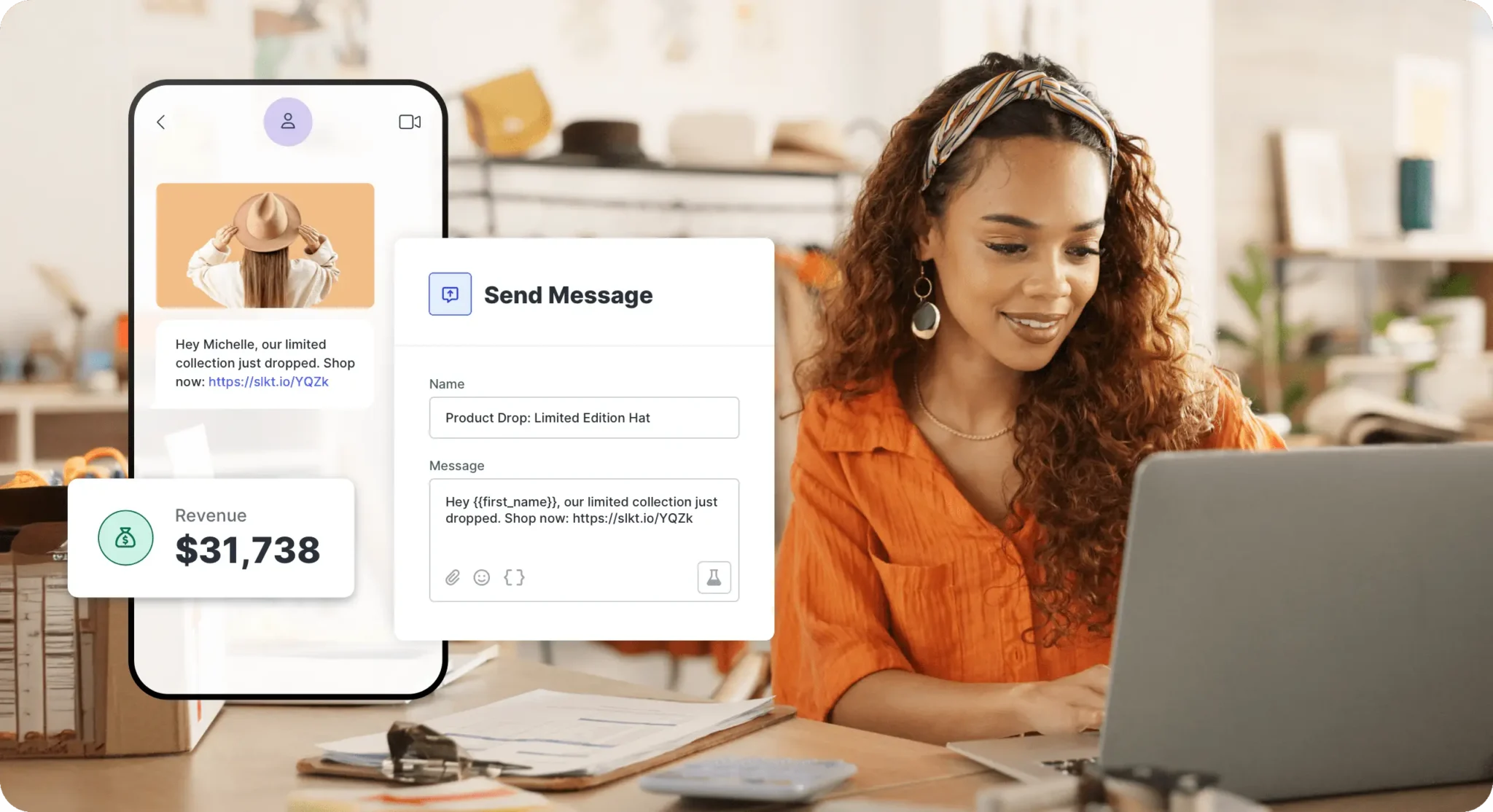

As trading teams grow, communication needs expand. SMS platforms are inherently scalable, capable of supporting a handful of users or thousands of recipients. Bulk messaging features allow leaders to send alerts to an entire group simultaneously, ensuring no one misses critical updates.

ROI on SMS Adoption

A financial institution reported a 20% reduction in communication costs after switching to SMS for its internal alerts. Additionally, they observed improved response times and higher engagement rates among their trading teams.

The Future of SMS in Trading

The evolution of SMS in trading is far from over. Emerging technologies like AI and automation are poised to enhance its capabilities, making it an even more powerful tool for the financial sector.

AI-Driven Alerts

AI-powered trading platforms are already integrating SMS for personalized alerts. These systems analyze market conditions and send tailored recommendations directly to traders phones. For example, a trader might receive an SMS like, “Alert: Stock XYZ has reached your target price. Consider selling.”

Two-Way Communication

The future may also see SMS enabling two-way interaction with trading systems. Traders could execute trades, request data, or adjust alerts simply by replying to a text message. This level of integration would bring unprecedented convenience to trading groups.

Overcoming Challenges

While SMS is highly effective, it isn’t without challenges. Spam messages and overuse can lead to message fatigue. However, advanced filtering systems and prioritization tools are addressing these issues, ensuring traders only receive relevant and actionable messages.

Conclusion

In an industry where milliseconds can mean millions, SMS has emerged as a critical tool for trading groups. Its speed, security, simplicity, and cost-effectiveness make it an ideal choice for facilitating communication in high-pressure environments. As technology continues to evolve, SMS is set to play an even greater role in shaping the future of trading.

Trading groups that embrace SMS now will gain a significant competitive edge. Whether you’re a small team of independent traders or part of a global institution, the time to integrate SMS into your communication strategy is now. With SMS, you can stay connected, informed, and ahead of the game.